Equity Residential (NYSE: EQR)

Business Overview:

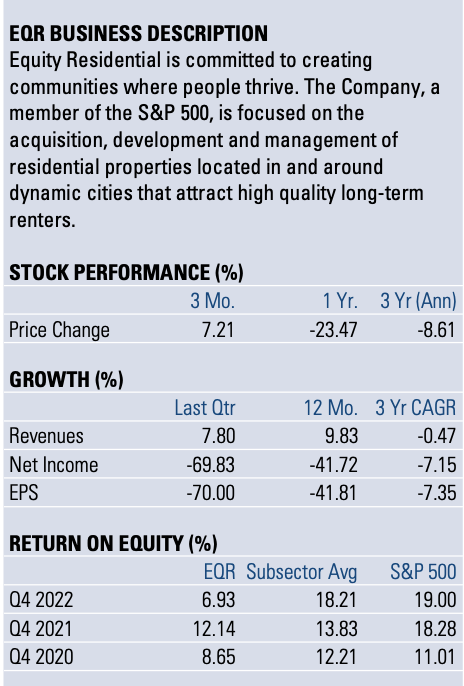

Equity Residential is a preeminent, fully-integrated, publicly-traded multi-family real estate investment trust (REIT) in the United States. This S&P 500 constituent boasts a portfolio of top-notch apartment properties in highly coveted markets across the nation. Although the company has established a solid presence in prominent locales such as Boston, New York, Washington D.C., Seattle, San Francisco, and Southern California, it is expanding its footprint in emerging markets like Denver, Atlanta, and Austin. The company bifurcates its performance assessment into residential and non-residential operations. As of December 31, 2022, EQR owned or had interests in 308 multifamily properties with 79,597 units nationally.

Equity Residential’s corporate strategy centers on optimizing returns for its shareholders by focusing on markets that have high barriers to entry, robust income and employment growth, and an appealing quality of life. Markets where entry barriers are high, such as in areas with limited land availability or stringent government regulations, make it more challenging and costly to develop new apartment properties. Apartments are primarily driven by household formation and employment growth, while supply is generated through the construction of new housing units, including single-family homes, multifamily apartment buildings, and condominiums.

In 2022, the average physical occupancy rate was 95.9%, which represents a slight decrease from the 2021 rate of over 96.0%. EQR has strategically divested a majority of its ranch style properties in recent years, redirecting its focus towards garden and mid-rise/high-rise assets located in urban markets. Garden-style properties, which typically consist of two or three floors, and mid-rise/high-rise properties, which consist of more than three floors, are now the primary focus of EQR.

Financials:

Same Store Income

Same Store Expenses

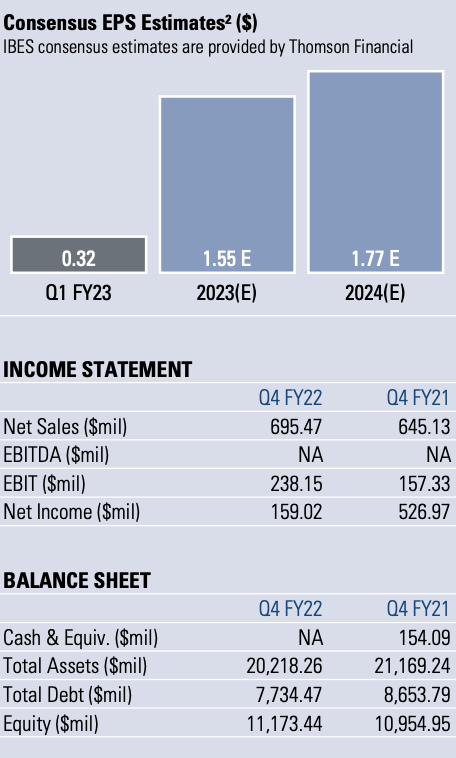

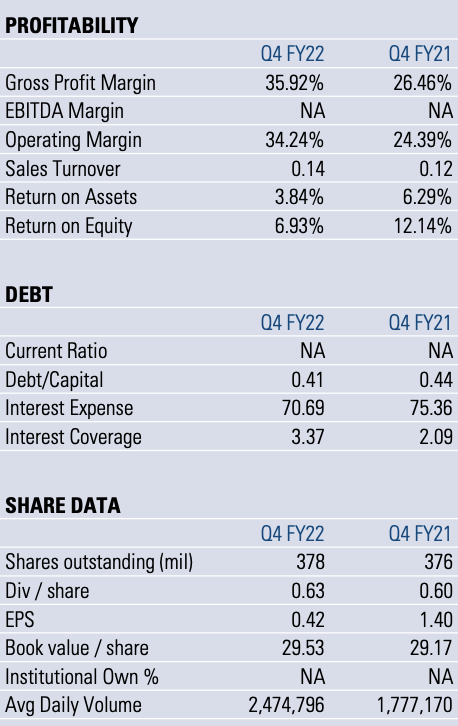

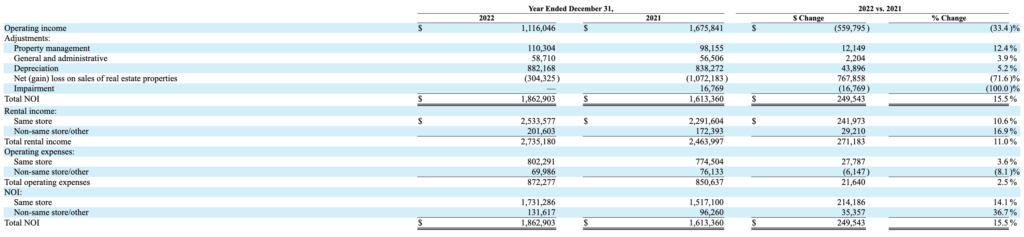

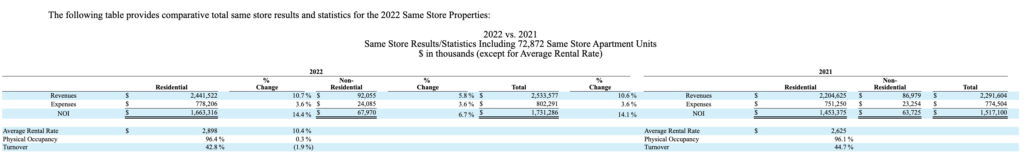

Same-store rental income, which increased ~11% from 2.29B in 2021 to 2.53B in 2022, was primarily driven by strong Physical Occupancy and rental growth.

Non Same Store Income

Non same-store income increased ~17% YoY primarily due to acquisitions and dispositions that each had their own impact on NOI.

Same-store expenses also grew ~4% YoY primarily due to:

Utilities: $13.9MM increase in gas & electricity due to increased commodity prices.

Repairs & Maintenance: The increase of $9.9MM was propelled by both volume and the timing of maintenance, in addition to the increases in the minimum wage for contracted services.

Non Same Store Expenses

EQR was able to decreased non same-store expenses by 8.1%.

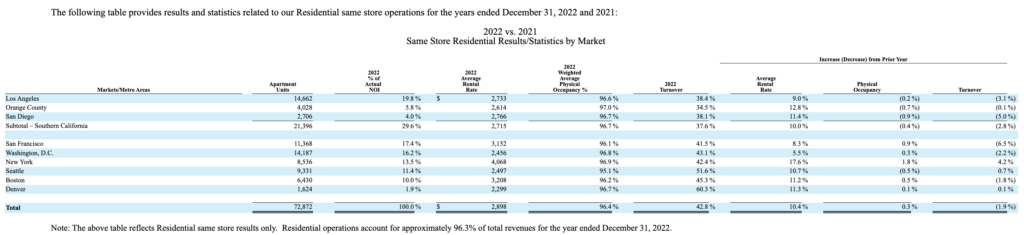

The table above provides a comprehensive breakdown of the markets in which EQR invests, along with the corresponding percentage of Total NOI generated from each market. Southern California makes up just about 30% of total NOI. In Q4 2022, the percentage of residents renewing was 56.5%, a positive indicator of EQR’s success. EQR reported that turnover in 2022 was the lowest it has ever been, at 42.8%, demonstrating a robust trend of strong resident retention throughout the company’s history.

Guidance:

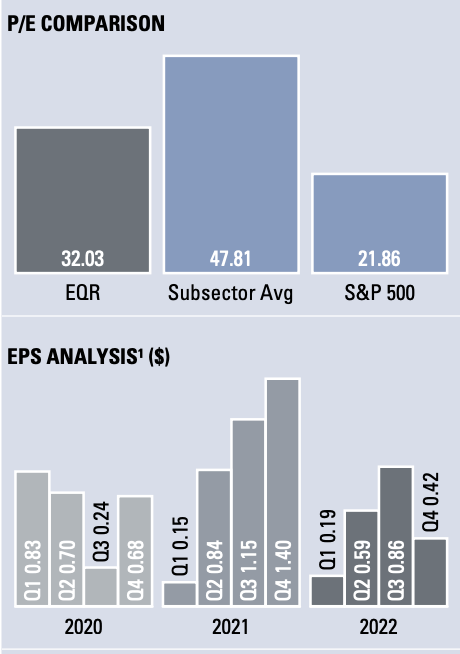

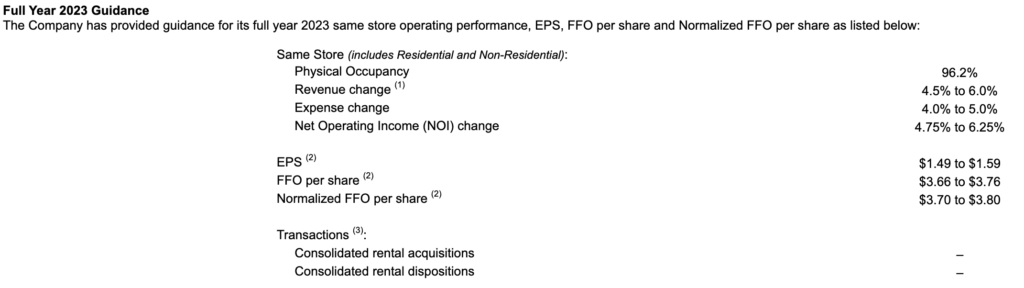

Equity Residential provided earnings guidance for full year 2023. For the year, the company’s same store revenue growth expects to be between 4.5% and 6.0%. The company expects EPS to be $1.49 to $1.59.

EPS guidance midpoint of $1.54 is due primarily to lower expected property sale gains.

Equity Residential Portfolio

(11/306) Total Properties

For more information on Equity Residential (NYSE:EQR) can be found in their latest 10-K found at https://www.sec.gov/ix?doc=/Archives/edgar/data/906107/000095017023003060/eqr-20221231.htm