The Essential Guide to Valuing Commercial Real Estate: Mixed Use (Retail/Residential) Appraisal Example - New York, NY

When it comes to buying or selling commercial real estate, accurate valuation is key. Whether you’re looking to invest in a new property or trying to determine the value of a property you already own, understanding the different methods for valuing commercial real estate can help you make informed decisions. In this post, we’ll take a look at some of the most common methods for valuing commercial real estate, including the comparable sales approach, income approach, and replacement cost approach. By understanding how each method works, you’ll be better equipped to determine the value of any commercial property.

For this example, we are going to use a sample commercial appraisal from 2015. You can find the complete redacted report at: https://www.manhattanrealestateappraisal.com/wp-includes/samples/Commercial-Sample-3.pdf

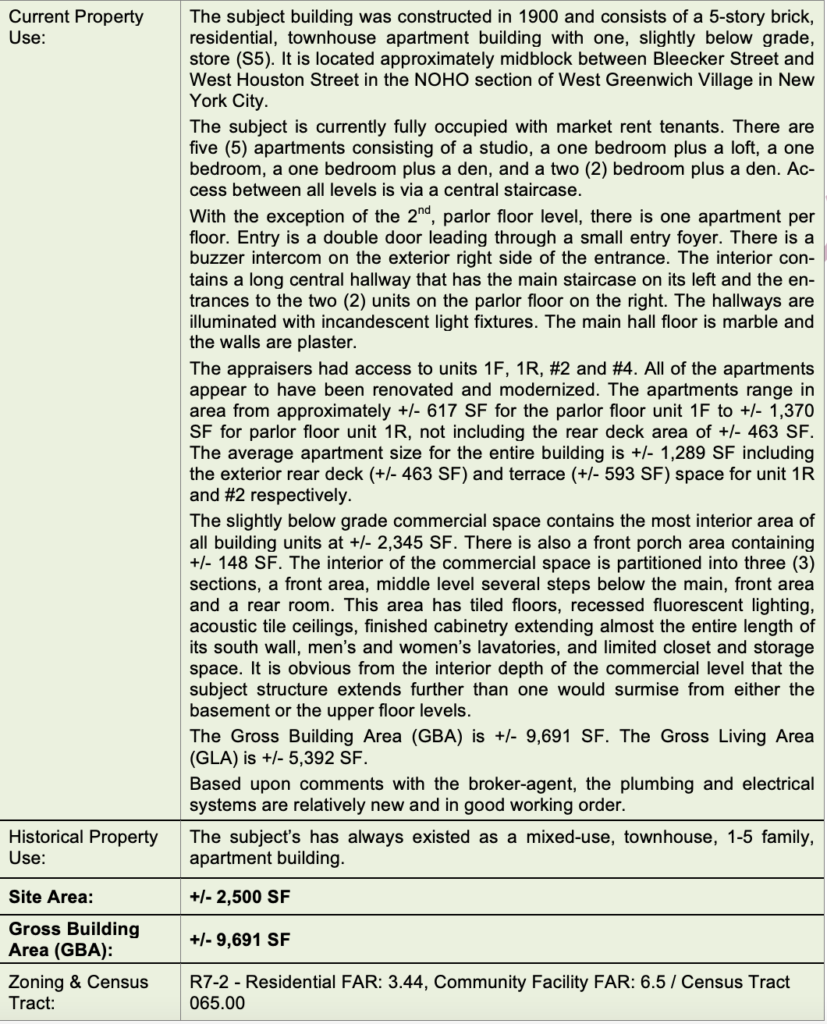

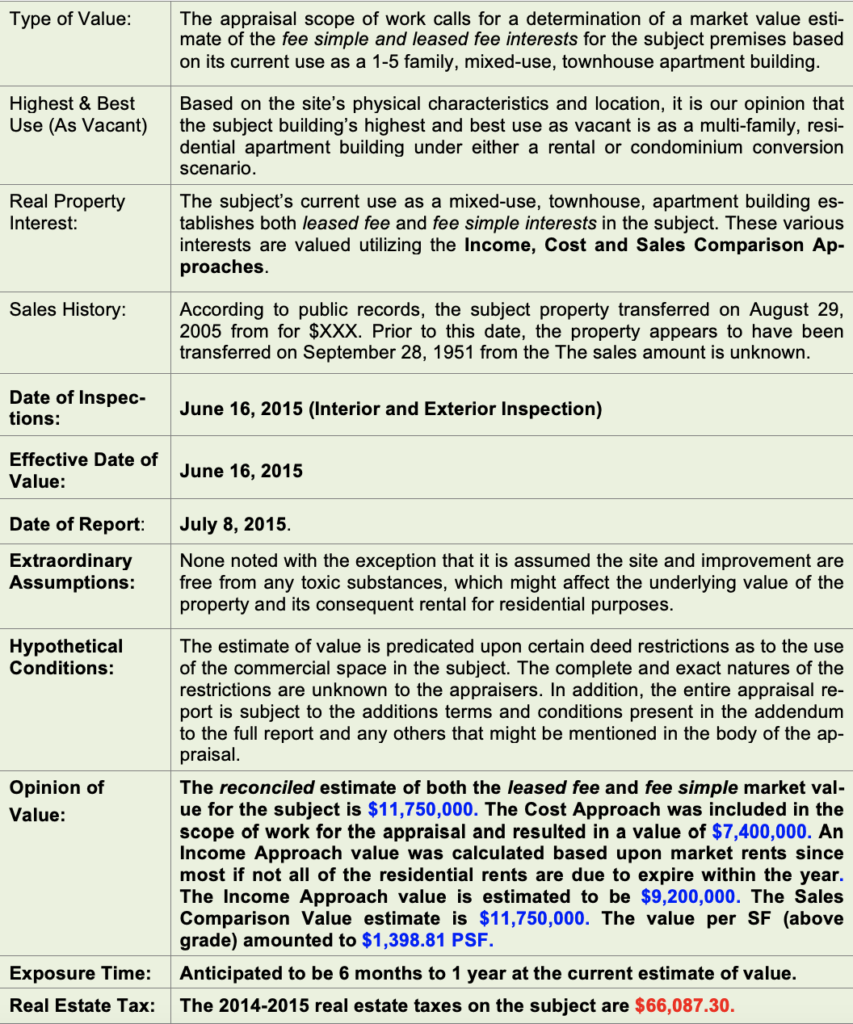

Below is an overview of the appraisal report.

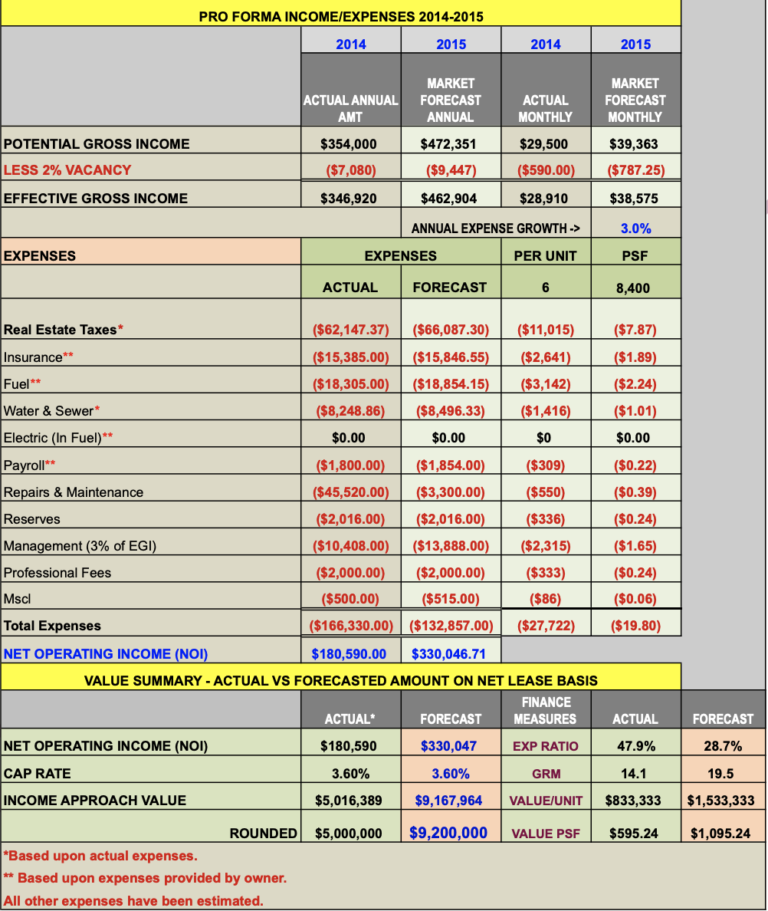

Income Approach

The income approach in commercial real estate is a method of valuing a property based on the income it is expected to generate. This approach is commonly used to value properties such as office buildings, retail centers, and apartments. The income generated by a property is typically considered to be a reliable indicator of its value.

Under the income approach, an estimate of the property’s future income is calculated, and then a capitalization rate is applied to that income to determine the property’s value. The capitalization rate is a measure of the rate of return that an investor can expect to earn on a property, and is often determined by comparing the returns of similar properties in the same market.

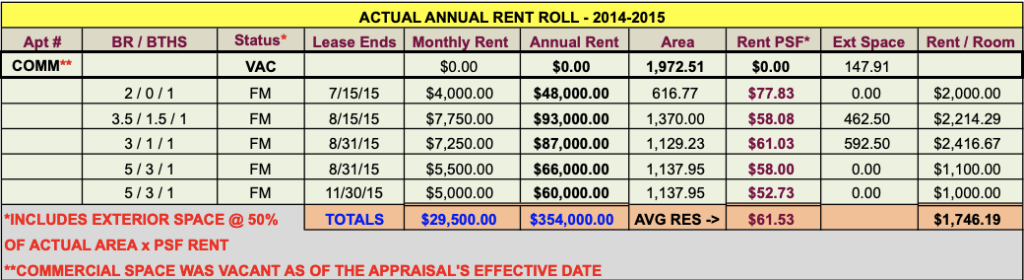

Above is the in-place rent roll at the time of the purchase. The obvious value-add component here is the vacant ~2k SF of commercial space.

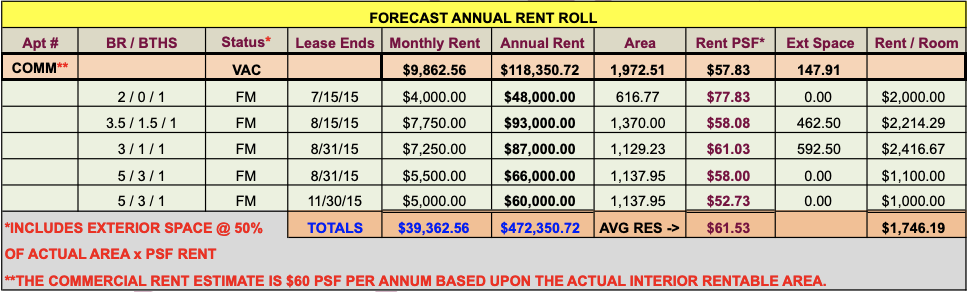

As you can see, leasing the vacant space can increase the rent roll by ~$120K. All else equal, this $120K increase in NOI should increase value by $3.3MM ($120k / 3.6%).

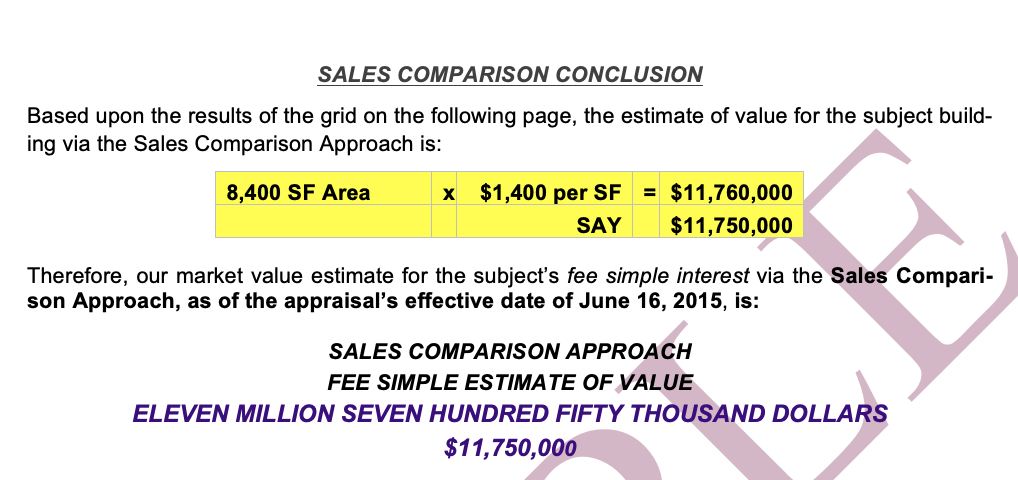

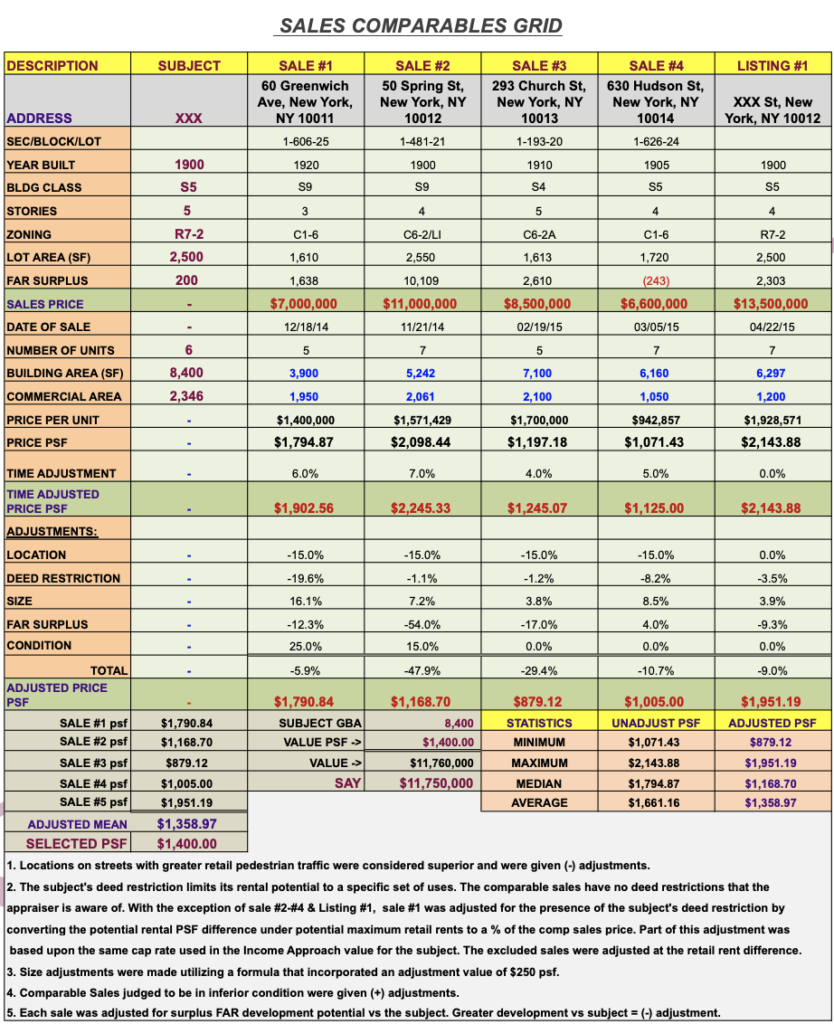

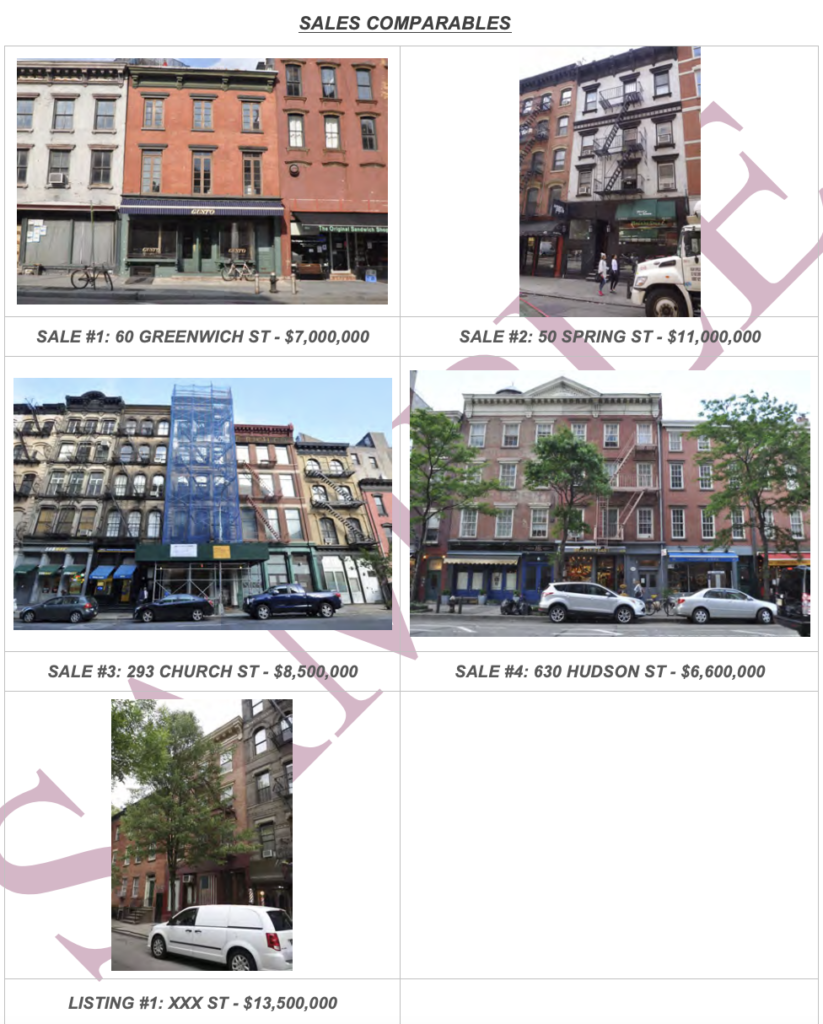

Comparable Sales Approach

A comparable sales real estate appraisal is a type of appraisal that estimates the value of a property by comparing it to similar properties that have recently sold in the same area. The appraiser will look for properties with similar characteristics, such as size, age, location, and condition, and will use the sale prices of these properties as a basis for determining the value of the property being appraised. The comparable sales approach is a commonly used method of real estate appraisal, as it allows the appraiser to consider the current market conditions and the demand for similar properties in the area. It is often used in conjunction with other types of appraisals, such as the cost approach or the income approach, to help provide a more complete and accurate estimate of the value of the property.

Cost Approach

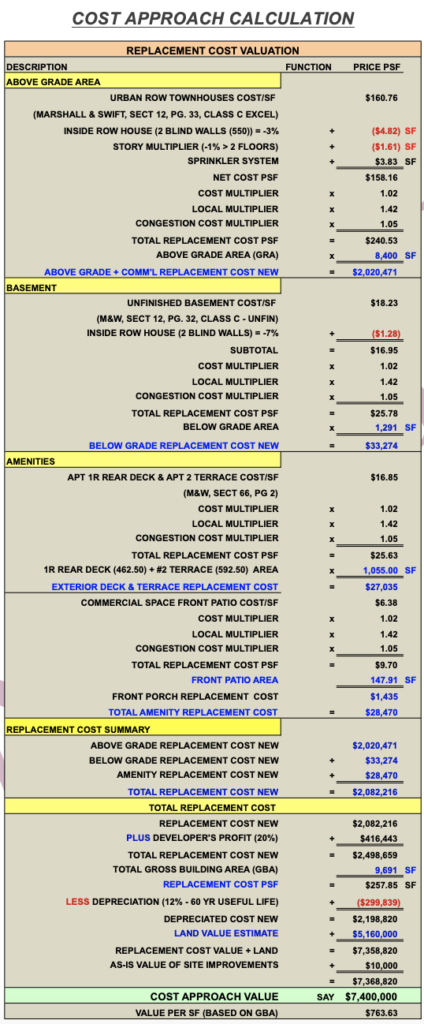

A replacement cost appraisal is a common valuation method used in the real estate industry to determine the cost to replace a property with an identical or similar one. This type of appraisal is particularly useful for properties that have unique features or characteristics that would be difficult to replace or replicate.

To determine the replacement cost of a property, appraisers typically use cost estimating software or tables that take into account the current cost of materials and labor in the area where the property is located. This information is combined with data on the property’s age, condition, and unique features, such as custom finishes or high-end appliances, to arrive at a final estimate.

It’s important to note that a replacement cost appraisal does not take into account the value of the land on which the property is located. Therefore, the value of the land must be estimated separately and added to the replacement cost to arrive at the property’s total value.

In addition to determining insurance coverage and potential resale value, replacement cost appraisals are also used by lenders to ensure that the property being used as collateral for a loan is adequately insured. This helps protect the lender’s investment in the event of a loss or damage to the property.

Overall, a replacement cost appraisal is a valuable tool for property owners, insurers, lenders, and real estate professionals to accurately assess the value of a property based on its unique features and characteristics, as well as the current cost of materials and labor.