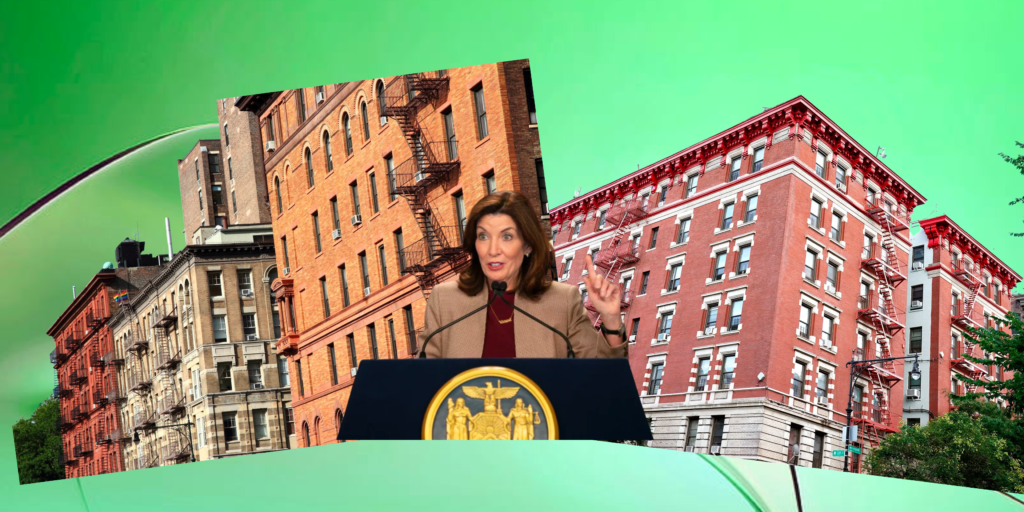

In the bustling metropolis of New York City, the real estate sector is experiencing a crisis, particularly within rent-stabilized buildings. The turmoil intensified with the recent legislative actions, including a bill signed by Governor Kathy Hochul in December 2023, expanding the definition of fraud in rent overcharge cases and further complicating the landscape for landlords and tenants alike.

The crisis at New York Community Bank (NYCB), with approximately 22% of its loan book tied to these buildings, underscores the severity of the situation. A dramatic halving of the bank’s stock value in late January, following a dividend cut to prepare for loan-related losses, signals the financial distress rippling through the sector.

The foundation of this turmoil was laid by the “Housing Stability and Tenant Protection Act of 2019,” which severely restricted landlords’ abilities to increase rents and deregulate rent-stabilized apartments. The act was a significant shift, aiming to enhance tenant protections but leading to unintended consequences for property owners. Combined with eviction moratoriums, rising interest rates, and increasing operating costs, landlords found themselves in a perfect storm of financial strain.

Adding to the complexity, Governor Hochul’s recent legislative move has sparked concern among landlords. The legislation amends fraud definitions and codifies rules limiting rent on “Frankenstein” apartments—when vacant, rent-regulated apartments are combined. This has led to fears of a surge in rent overcharge cases and heightened scrutiny over building renovations, posing yet another challenge to the already beleaguered rent-stabilized market.

Sugar Hill Capital Partners’ default on significant debt in November 2022 exemplified the early signs of distress within the sector, highlighting the profound impact of regulatory changes on landlords. As more property owners face defaults and financial distress, the narrative around the industry’s challenges has evolved, with foreclosure actions and defaults on multifamily loans underscoring the widespread nature of the crisis.

Landlords have attempted to mitigate losses by divesting properties, often at a loss, to avoid default. Sales at significant discounts reflect the desperation and financial pressures facing owners, further indicating the deepening trouble for both landlords and lenders.

The enactment of Governor Hochul’s bill, aimed at addressing loopholes and providing clarity to the 2019 act, has been met with mixed reactions. While tenant advocates hail it as a victory for housing justice, landlords and industry representatives predict it could exacerbate the difficulties facing rent-stabilized housing. The legislation restricts landlords’ ability to raise rents through renovations and combines units, with significant implications for the financial viability of these properties.

This evolving crisis underscores the need for a balanced approach to housing policy—one that protects tenants without undermining the financial stability of rent-stabilized buildings. As New York grapples with the consequences of these legislative changes, stakeholders across the board are calling for dialogue and solutions to navigate the challenges ahead. The actions taken now will shape the future of the city’s housing market, with the hope of finding a path that ensures both tenant protections and the health of the rent-stabilized sector.